The Trap of Normal: Why Thinking Like Everyone Else Holds You Back

Even though your broker makes all the tools under the sun available to you, no one is immune to the statistics of the financial markets. Unless you have gone through some sort of structured training or you have been schooled by someone who is walking the path you yourself want to walk on, or you give this endeavour some serious thought, you will most likely fail in the financial markets.

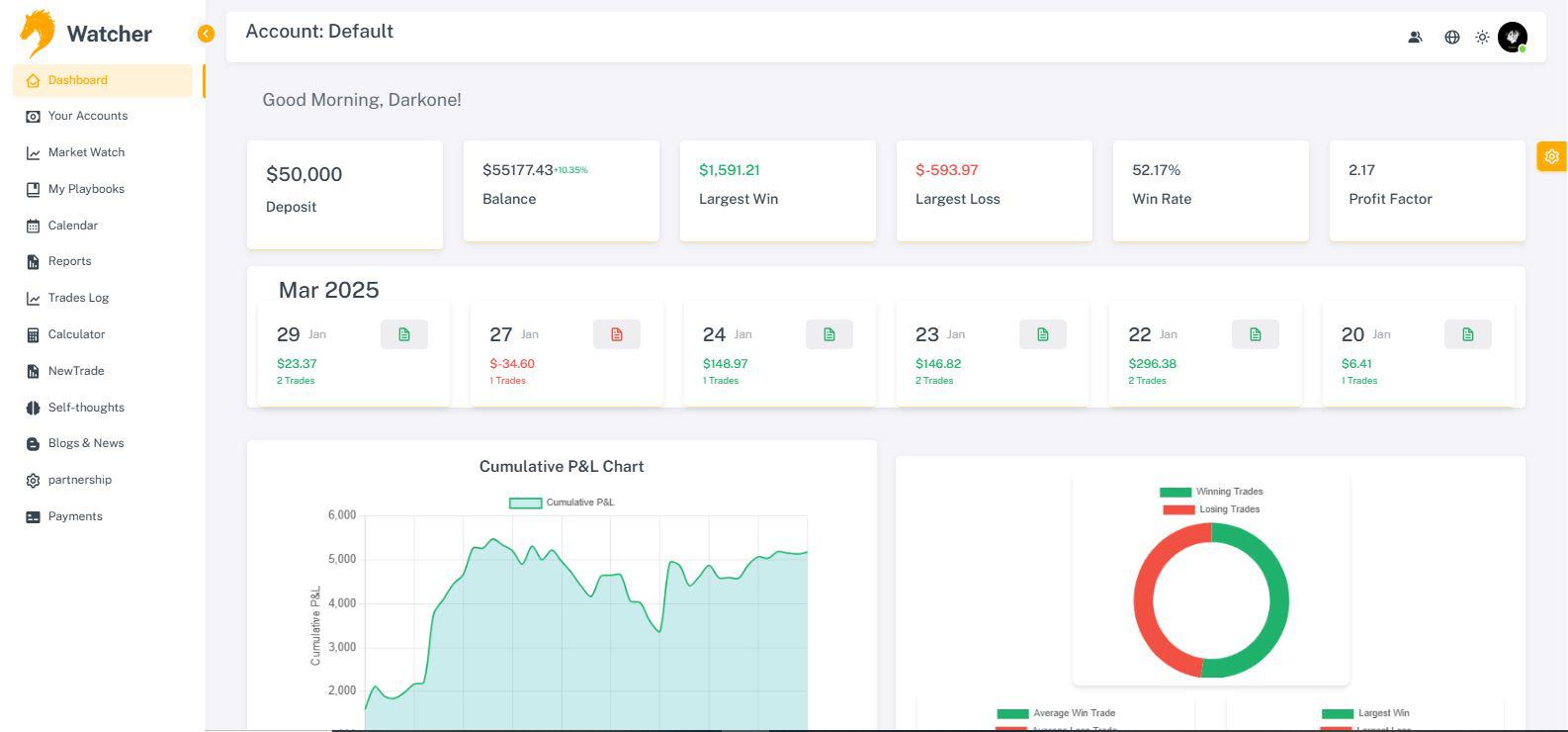

Look at any broker website in the European Union, and you will see the failure rate. The brokers are obliged by law to post them on the front pages of their websites. Here are some of the biggest and most well-known CFD brokers in the world, and their failure rates:

| BROKER | FAILURE RATE |

| IG Markets | 75% |

| Markets.com | 89% |

| CMC Markets | 75% |

| Saxo Bank | 74% |

| FX PRO | 77% |

Rates correct as of 7 November 2019.

I know you like to think you are different. However, in the eyes of the financial markets, you are statistically like everyone else.

You can look at the top ten brokers of the world and the statistics do not change. You can look at CMC Markets, you can look at IG Markets, you can look at Gain Capital, or you can look at any one of the top tier or second tier CFD brokers. No one will have a failure rate less than 70%.

There is one exception to this. I found a broker that has a 59.6% failure rate. I suspect it is because of their tight fixed spreads. The spread does matter immensely to the profitability of your trading, especially as a day trader. The spread is the silent commission. Still, I don’t think that a 59.6% failure rate is too impressive either.

Normal is bad

What is the point that I am trying to get across to you?

I’m trying to make you see trading for the holistic enterprise that it really is. I am doing my best to make you understand that fundamental analysis or technical analysis or whatever tool you are using for your trading will simply not make you money over time, unless you add another ingredient to your trading. This ingredient is not easy to acquire, mostly because people are looking in the wrong place.

If you want to be a good a trader, if you want to achieve the level of success that you know is possible, you immediately need to stop thinking that the path to riches in trading has anything to do with the tools or techniques you are using.

Yes of course you need a strategy. Yes, you need a plan. Yes, you need to understand the markets. So, what is this book all about, if it is not about tools and strategies?

Well, let me address that question from a different perspective. Let me address it from the perspective of the people who work in the industry as brokers and sales traders and as marketing people. Do they trade? I would say most likely they do not. Yet, you are taking advice, guidance and training from them. You are being guided by people who are no better at it than you are.

It reminds me of Fred Schwed’s book, Where are the Customer’s Yachts?, where he says that Wall Street is the only place in the world where people who arrive to work by train and bus give advice to people who arrive by limousine and helicopter (slightly paraphrased for a more modern touch). You are being guided by people who can’t trade!

Guided by the blind

When you go to trading shows, read trading magazines, or look at the online education materials on broker websites, 100% of the focus is on what I call How To:

- How do I scalp?

- How do I swing trade?

- How do I day trade?

- How do I trend follow?

- How do I trade the FX market?

- How do I use Ichimoku charts?

- How do I trade with MACD or Stochastics?

This is perfectly normal. The trade shows and magazines are geared towards providing you with solutions most people believe they need to make money in the financial markets. The brokers are following the same path. They provide you with the information that they think you need and that you think you need.

As a newcomer to the industry of trading, you are most likely guided by the very people who are likely to set you off on the wrong path. You are led to believe that it is all about technique and strategy, and no one is preparing you for the fact that it isn’t a strategy that will set you apart from other traders.

It is how you think about your strategy and your ability to follow the strategy that will set you apart.

Do you not wonder if this is the right path for you? Do you not wonder about the futility of dedicating all your resources to one pursuit, when virtually everyone who walked that path before you has failed? It should. You really should ask yourself what makes you different to the 90% of traders that do not make money. If you are normal, as in you do what everyone else is doing, then you won’t make it.

NORMAL WILL NOT CUT IT

I was invited by the organisers of one of these trade shows to give a talk. This one was in London, and I was told I could talk about whatever I wanted. I decided to give a talk about the disastrous failure rate in the trading industry.

My argument is that if 90% of all CFD accounts lose money, the problem is a human problem. I feel I am making a reasonable assumption when I say that everyone opening a CFD account is a normal person with a normal way of thinking. Therefore, I conclude that there must be something inherent in the way normal people think and act that makes trading so unsuccessful for them.

Why is there such a high failure rate in trading?

This is a human problem. It is not a broker problem. It is not a market problem.

It should be easier than ever.

When I started in this business 20 years ago, the spread in the DAX was 6 points intra-day and the spread in the Dow index was 8 points intra-day. Today, these indices have doubled or tripled from their price levels of 20 years ago (Dow was around 10k, and DAX was around 6–7k), yet the spread has come down to just 1 point with some of the brokers I trade with. I mentioned above how small spreads are compared to twenty years ago.

Therefore, it should be easier than ever for traders to make money. However, it isn’t. People are still struggling to make money trading. My main premise for this book is to get to the bottom of this conundrum. The approach I have taken is centred around the following facts:

- It has never been easier to trade. The IT infrastructure is superb for traders.

- The spreads have never been lower.

- The margins have never been more favourable.

- The tools have never been so readily available.

- The brokers have never done so much for their clients as they do now.

- The stock indices have never been higher, meaning there is volatility.

Additionally, I assume that people who open trading accounts are normal, well-adjusted human beings, who are perfectly capable of functioning within society. I assume they are normal, without using the word normal as a slight or an insult.

The question I want to ask, and answer, is this: What does normal behaviour look like? How can I avoid being normal when I trade? The assumption is that the 80–90% of people trading are normal people, and I want to avoid acting like they do.

Are you normal?

My argument, provocative as it is, in its simplicity, asks an essential question: Are you thinking like everyone else is thinking? Are you approaching trading like everyone else is approaching trading?

If so, you may have a problem.

If you think like everyone else, is it so strange that you get the results that everyone else is getting?

What normal people do

Let us take a look at what normal behaviour is.

Normal behaviour is to engage in a never-ending cycle of education – looking for the next new edge. I knew from the moment I read Liar’s Poker that I wanted to be a trader, but I never had any formal training on how a good trader behaves. Why should I? I was always told that a good trader buys low and sells high.

Except for every time I bought low, it always went lower and lower. What kind of advice is that?

And yet this is what we listen to when we start. This is the benchmark, and if this is the benchmark, then it is a miracle that it is only 90% that are losing. It should be 100% because buying low and selling high is a sure recipe for ruin.

People will learn to use tools such as candlestick analysis. People will attend weekend courses hoping to learn secrets. People will study the use of tools such as stochastics, RSI, MACD, moving averages, and the list goes on and on and on. This is normal behaviour in a nutshell.

Even the bible

Even the bible of technical analysis doesn’t do much to help a person on their way – once the initial learning curve is over. Over the years, many a Wall Street acolyte has made pilgrimages to the Trinity Church Bookstore to buy the bible. Not the King James version, mind you, but the bible for technical analysis authored by Edwards and Magee, Technical Analysis of Stock Trends, which has sold more than 800,000 copies since its first printing in 1948.

What most readers don’t realise, however, is that Edwards and Magee were not the real creators of modern technical analysis. It was a little-known technical analyst named Richard W. Schabacker.

A brilliant market technician, Schabacker codified almost everything there was to know about technical analysis up to his time – which included such pioneering work as the Dow Theory of Charles Dow. Between 1930 and 1937, Schabacker taught several courses to serious Wall Street traders and investors. Unfortunately, he died in 1938 when he was less than 40 years old.

Shortly before his death, Schabacker gave a mimeographed copy of his lessons to his brother-in-law, Robert D. Edwards, who rewrote Schabacker’s lessons with the help of his collaborator, John F. Magee, an MIT-trained engineer. As a result, it was not Schabacker who received credit for the original compilation of technical analysis, but Edwards and Magee, whose work became a perennial bestseller.

Let me be clear. Reading a book like Technical Analysis of Stock Trends is a must, but please don’t think that it will make you a professional, profitable trader, anymore than reading a manual on tennis will enable you to compete with Rafa Nadal.

I’ll give you an example. Yesterday, 1 October 2019, was a particularly bearish day in the Dow index and the DAX index. I was short all day and I had one of my better days, all verified and documented on my Telegram channel.

Towards the end of the day, when the Dow index was falling even lower, a student of mine contacted me and asked me a very alarming question.

“Darkone, do you think it is a good idea to buy now, ahead of the close?”

I reply: “hmm, I am short… maybe you should ask someone else.”

He replies: “well, the Dow has fallen so much today. Maybe it will bounce towards the close.”

No professional trader would in their right mind engage with the market ten minutes before the close. Why are you buying the Dow ten minutes before the close on a day where Dow has fallen 400 points? You have had all day to find a short entry. What are you hoping to achieve, by being a buyer now? Are you thinking that because it has fallen 400 points that now it is cheap, and maybe just before the close, you may see some buying of these cheap stocks? I used to think like that too. That was when I was not profitable.

The Dow didn’t rally into the close. There was no bounce. I am sure my student didn’t lose a lot. It wasn’t so much his wallet I was concerned about. It was his way of thinking. That is what this book is about. It is about making you think the right way about the market. That is where the 80–90% of losing traders tend to go wrong.

The 90% vs the 10%

We are all pretty much normal people. We need to be to fit in and function well within the fabric of modern society. If every person engaged in trading is a normal human being, meaning they are well-functioning, intelligent, considerate, hard-working, then why is there a 90% failure rate in our industry? That doesn’t make any sense at all. Usually when people work hard at something they will succeed, or they will see some degree of success. That doesn’t appear to be the case with trading.

Other professions do not have a 90% failure rate!

As traders, we tend to engage in a never-ending, predictable cycle. We do well for a while. We are happy and our discipline weakens. We lose money. We strengthen our resolve, and we get more education. We do well for a while. We lose money, we engage in more education.

Sounds familiar?

Am I against education? No, I am against people thinking that all it takes is more education. Sure, it takes education, but it must be the right kind of education.

It is true that I myself run one- and two-day courses, so I could easily stand trial for being a hypocrite. In my courses I tell people that for every hour you spend on technical analysis, you must set aside at least 25% of that time to what I call internal analysis.

You need to know what your weaknesses are. You need to know what your strengths are. You need to know what you are good at and you need to know what you are not good at. If you don’t spend time trying to improve that, how will you get better? Very few people, if any, will engage in that level of introspection in order to gain the results they want.